Hey, did you manage to get those contracts signed yet?” Sarah asked, her voice tinged with a mix of curiosity and sympathy.

Mariam sighed, glancing at the stack of papers on my desk. “Not yet. I’ve been chasing signatures all morning, and it’s like herding cats.”

Sarah chuckled knowingly. “Tell me about it. I spent half of yesterday tracking down our CFO just to sign off on an expense report.”

Frustration hung in the air as they commiserated over the painstaking process of obtaining crucial financial documents, which had to be signed, sealed, and delivered. Little do they know, e-signatures could solve their problems in a few minutes.

What Exactly Are E-Signatures?

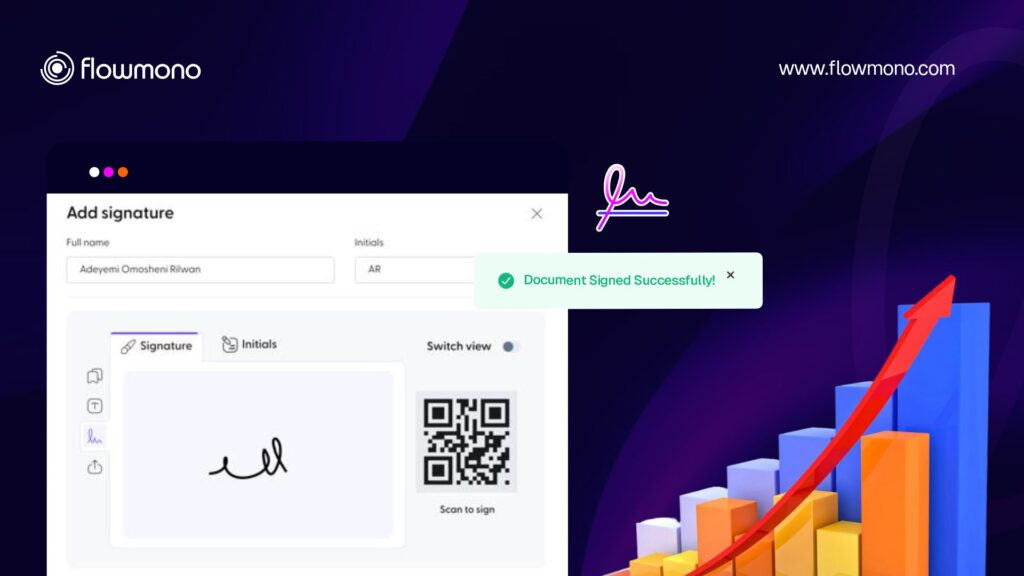

E-Signatures, short for Electronic Signatures. Simply put, it is a way of signing documents digitally from any device. They have revolutionized the way agreements and contracts are signed in the digital age. These signatures replace the need for traditional ink-on-paper signatures, offering a secure and legally recognized method for individuals and businesses to sign documents electronically. E-signatures are encrypted, ensuring data security and authentication, which is crucial in financial transactions.

The Legal Validity of E-Signatures

One of the primary concerns surrounding e-signature implementation is its legal validity. People find it hard to trust the concept of electronic consent. Fortunately, many countries, including Nigeria, have adopted regulations such as the Electronic Signatures in Global and National Commerce (ESIGN) Act and the EU eIDAS Regulation. These regulations validate the use of E-Signatures in various legal documents, ranging from contracts to tax forms. E-signatures are also backed up by the Nigerian constitution under the Evidence Act of 2011. As a result, businesses can confidently incorporate E-Signatures into their workflows, knowing that they hold legal weight.

The Benefits of Flowmono E-Signatures in Financial Workflows

1. Time Efficiency: Traditional methods of signing documents involve physical presence and transportation of papers, leading to delays in processing. E-signatures eliminate these bottlenecks by enabling individuals to sign documents from anywhere, at any time. Companies that go paperless reduce 90% of their processing errors on average. Flowmono Bulk signing expedites contract execution and accelerates finances, boosting overall operational efficiency by giving the option to sign multiple documents at the same time 41% of companies require signatures on more than half of their documents, printing more than half of their papers to get them signed. With Flowmono bulk signing, there is access to unlimited document uploads regardless of the plan you are on.

2. Cost Savings: The cost of paper, printing, postage, and storage can add up significantly for businesses. Companies that adopt e-signature solutions reduce document handling expenses by a whopping 85%. E-signatures eliminate the need for paper-based processes, reducing administrative costs and promoting a greener approach. Additionally, the time saved by expediting document processing translates to higher productivity and revenue generation, as companies can also save up to 80% on shipping costs on stationery when they go paperless on average.

3. Enhanced Security: Security is paramount in financial transactions. Flowmono E-signatures employs advanced encryption techniques to safeguard documents from tampering and unauthorized access. Multi-factor authentication adds an extra layer of protection to financial data encryption, ensuring that only authorized parties can access and sign the documents. This level of security is crucial when dealing with sensitive financial information.

4. Audit Trails and Compliance: Maintaining a clear audit trail is essential for regulatory compliance and accountability. Flowmono E-Signature platforms provide detailed logs of every action taken during the signing process, including who signed, when, and from which device. This gives detailed tracking of signings on documents, document views, and approvals. Thereby simplifying the auditing process, helping businesses meet regulatory requirements, and accelerates financial processes.

5. Remote Collaboration: Modern businesses often operate in geographically dispersed settings. E-signatures facilitate collaboration among teams and stakeholders regardless of their location. Remote contracts can be executed and agreements can be reviewed, signed, and shared seamlessly, eliminating the need for physical document exchange.

Implementing Flowmono E-signatures

To fully leverage the benefits of Flowmono E-signatures for efficient financial workflows, businesses will enjoy these best practices:

A. Customized Workflows: Different industries require varying levels of process authentication and approval. Our customized E-Signature workflows match the complexity of each process. For instance, simple internal financial approvals might require a single signature, while more complex contracts might need multiple signatures and approval tiers.

B: Educating Users: Smooth adoption of E-Signatures involves educating employees, clients, and partners about the benefits and proper usage. We conduct training sessions and demos to ensure everyone understands how to use the platform correctly and securely.

Regularly Update Security Measures

As technology evolves, so do potential security threats. We stay up-to-date with the latest security measures and undertake regular updates and patches that help protect sensitive financial information from emerging threats.

E-signatures have emerged as a game-changer in the realm of efficient financial workflows. Flowmono can expedite processes, enhance security, and streamline collaboration.

![]()